What is a Credit Score?

A credit score is a three-digit number that helps lenders estimate how likely you are to repay borrowed money. Scores typically range from 300 to 850, and higher scores reflect lower credit risk.

Your credit score can affect your ability to qualify for credit cards, auto loans, or mortgages — and the interest rate you receive.

Your credit score can affect your ability to qualify for credit cards, auto loans, or mortgages — and the interest rate you receive.

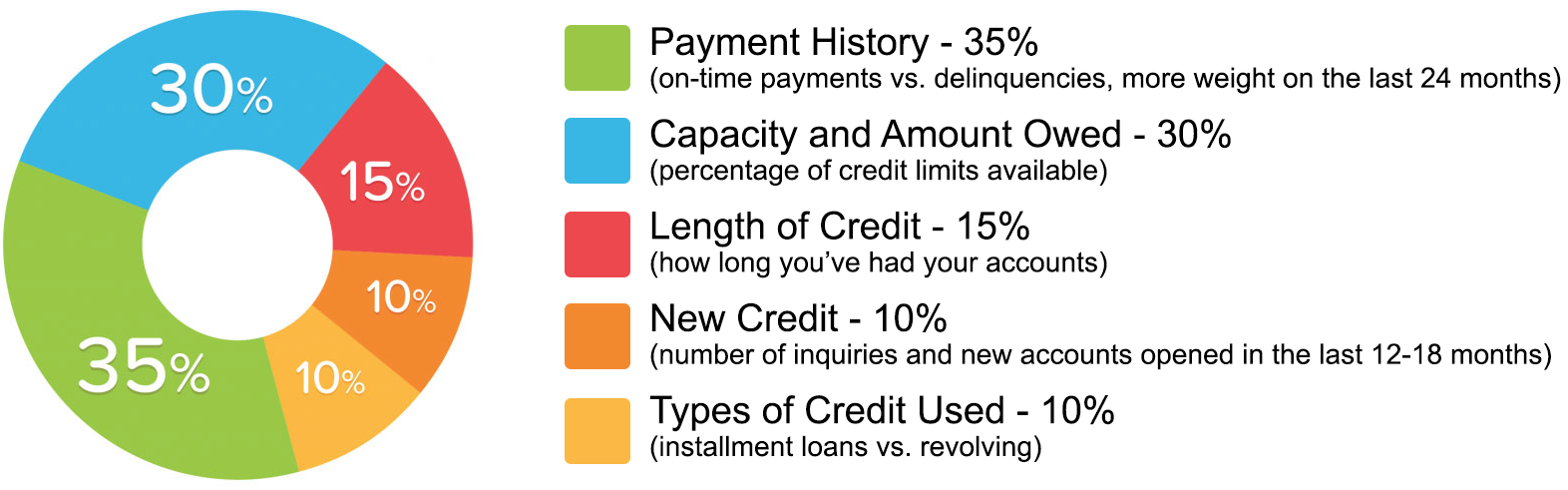

What affects your Credit Score?

We Help You Understand and Address Negative Items

Our credit education process is designed to help you:

- Identify inaccurate, outdated, or unverifiable accounts in your reports.

- Understand how to request corrections or updates from the credit bureaus.

- Learn strategies for responsibly rebuilding positive credit.

Credit Improvement Education

Here are steps you can take to maintain or improve your credit health:

- Pay on time — Payment history is the single most important factor.

- Keep balances low — Aim to use less than 30% of your available credit.

- Don’t close old accounts — Length of credit history matters.

- Limit new credit inquiries — Too many can temporarily lower your score.

- Monitor your credit — Review your reports regularly at: creditheroscore.com

How Long Items Can Remain on a Credit Report

Understanding the timelines helps set realistic expectations:

Late Payments Up to 7 years from the date of delinquency

Collections Up to 7 years from the original delinquency

Charge-offs Up to 7 years

Closed Accounts (Positive) Up to 10 years

Bankruptcies (Chapter 7) Up to 10 years from filing date

Bankruptcies (Chapter 13) Up to 7 years from filing date

Judgments / Tax Liens Typically up to 7 years (may vary by state)

Hard Inquiries 2 years

Late Payments Up to 7 years from the date of delinquency

Collections Up to 7 years from the original delinquency

Charge-offs Up to 7 years

Closed Accounts (Positive) Up to 10 years

Bankruptcies (Chapter 7) Up to 10 years from filing date

Bankruptcies (Chapter 13) Up to 7 years from filing date

Judgments / Tax Liens Typically up to 7 years (may vary by state)

Hard Inquiries 2 years

Information That Cannot Be in a Credit Report

- Race, religion, or national origin

- Marital status or number of dependents

- Income or net worth (unless part of a credit application)

- Medical diagnoses (unless authorized by you)

- Any information older than the legally allowed reporting period

Your Legal Rights

Under the Fair Credit Reporting Act (FCRA), you have the right to:

- Request a copy of your credit report once every 12 months.

- Dispute inaccurate or unverifiable items.

- Add statements of explanation to your credit report.

- Be notified if information in your report was used to deny you credit.

Disclaimer

The information on this page is provided for educational purposes only and does not constitute legal or financial advice.

CreditUp-Yours™ is a credit education and document-processing company, not a law firm or credit bureau.

Results vary depending on individual circumstances.

CreditUp-Yours™ is a credit education and document-processing company, not a law firm or credit bureau.

Results vary depending on individual circumstances.

These people had amazing results

|

"Credit Up-Yours turned my situation around fast. My score jumped over 100 points in just a few months, and I finally qualified for a new car loan. I can’t thank them enough!"

Callum R. |

"I was skeptical at first, but this team delivered. They removed old collections I thought would never go away, and now I’m back on track to buy my first home."

Dave I. |

"Professional, honest, and effective! They explained everything clearly and gave me hope when I felt stuck. Today my credit is stronger than ever."

Gloria G. |

Testimonials reflect individual experiences. Results vary and are not guaranteed. CreditUp-Yours™ complies with the Credit Repair Organizations Act (CROA) and does not claim specific score increases or timeframes.

Start your own credit success story today

Book your free consultation and credit analysis to learn how we can help you take the next step toward better credit

Credit Up-Yours™ is a credit education and document-processing company. We do not provide legal or financial advice.